SHILLONG:

GST is comprise of three components viz., State GST (SGST), Central GST (CGST) and Integrated GST (IGST). While SGST and CGST are levied on the transactions within a State, IGST is levied on inter-state transactions. For example, if a seller in Meghalaya bills to a buyer in Meghalaya, SGST and CGST will be levied on such sale with the SGST component accruing to the State and CGST to the Centre. If a seller in Assam bills to a buyer in Meghalaya, IGST will be levied on that sale and the proceeds will be shared equally between the Centre and the destination State, in this case Meghalaya. IGST is settled on

monthly basis between Centre and States.

Further, GST is paid in two modes namely Cash ledger and credit ledger. Suppliers of goods may pay GST using cash (through banks) via cash ledger. Such payment through cash ledger will be settled to the State on a daily basis. A supplier may pay the GST liability using

redit ledger too – which means the supplier uses the input tax credit available in his/her electronic credit ledger to set off the output tax liability. When a supplier uses redit ledger

for payment, all incoming and outgoing input tax credits for a State will be settled on a monthly basis and the net amount will be credited to the State.

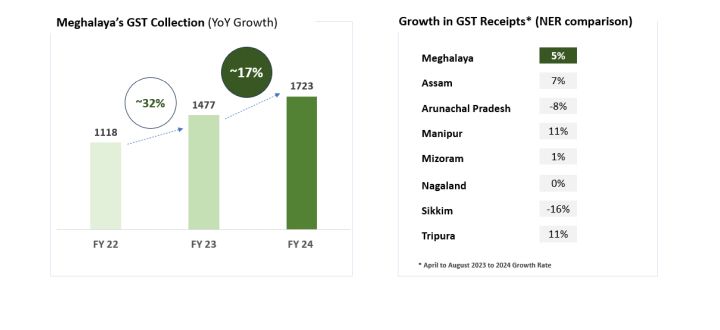

Thus, the State of Meghalaya receives its share of GST daily through cash ledger and monthly in the form of IGST and ITC settlement. The total GST receipts from April-August, 2024 for Meghalaya is Rs. 772 crores. The receipts for the same period in 2023 was Rs. 737 crores indicating an increase of 5% in the receipts. The growth rate for other States in the North East are – Assam 7%, Arunachal Pradesh 8%, Manipur 1%, Mizoram t, Nagaland o%, Sikkim -16% and Tripura 1%.

The State Government are taking up awareness creation activities, especially among the small shopkeepers who procure goods from outside the State, to ensure that the invoices are generated with Meghalaya addresses so that the GST accrues to Meghalaya.

Further, intensive scrutiny of returns is being carried out to check evasion. In the current Financial year 376 cases involving an amount of Rs 121 crores are under scrutiny.